GIFTS OF STOCK AND APPRECIATED ASSETS

GIFTS OF STOCK AND APPRECIATED ASSETS

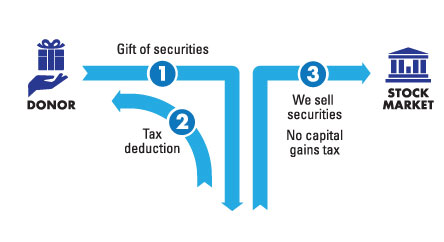

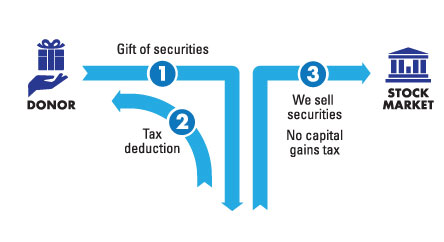

How It Works – You transfer appreciated stocks, bonds, or mutual fund shares you have owned for more than one year to The Arc of the St. Johns. The Arc of The St. Johns sells your securities and uses the proceeds for its programs. Ask your financial advisor for the appropriate forms to facilitate the gift.

Benefits – You receive an immediate income tax deduction for the fair market value of the securities on the date of transfer, no matter what you originally paid for them. You pay no capital gains tax on the transfer when the stock is sold. Giving appreciated stock could be more beneficial than giving cash.

GIFTS FROM YOUR WILL OR TRUST

GIFTS FROM YOUR WILL OR TRUST

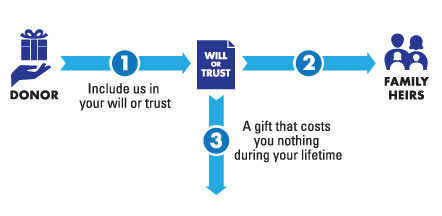

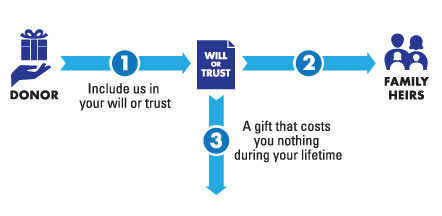

How It Works – Include a bequest to The Arc of the St. Johns in your will or trust. Ask your financial advisor for the appropriate language needed to include The Arc in your will or trust. Make your bequest unrestricted or direct it to a specific purpose. Indicate a specific amount or a percentage of the balance remaining in your estate or trust.

Benefits – Your assets remain in your control during your lifetime. You can modify your gift to address changing circumstances. You can direct your gift to a particular purpose (please check with us to make sure your gift can be used as intended). Under current tax law, there is no upper limit on the estate tax deduction for your charitable bequests

GIFT WITH LIFE INSURANCE

You can make a substantial gift by naming The Arc of the St. Johns as beneficiary or owner of your life insurance policy. Often, donating life insurance enables you to make a larger gift to The Arc than you otherwise could.

If you have an existing life insurance policy that is no longer needed to protect your children, your spouse, or your business interest, you can name The Arc as the policy’s beneficiary. Because the beneficiary designation is a revocable gift, you are not entitled to an income tax deduction. However, the value of the policy is deductible from your taxable estate. If you also transfer ownership of the policy to The Arc, you can immediately deduct the current value of the policy from your income taxes; if you are still paying premiums, you can deduct the cost of those premiums each year.

You also can purchase a new life insurance policy to benefit The Arc. With The Arc of the St. Johns designated as the owner and beneficiary, you are entitled to an income tax deduction for your initial contribution and the premium payments each year.

This type of gift is easy to make and can be done at no cost. Simply obtain a designated beneficiary form from your insurance company and name “The Arc of the St. Johns” as one of your beneficiaries.

For more information about naming The Arc of the St. Johns in your life insurance policy, please contact Neal Benson, Director of Development, at (904) 824-7249 ext. 121, or by email nbenson@arcsj.org.

A BENEFICIAL RETAINED LIFE ESTATE

A gift of a home is a very significant way to support The Arc of the St. Johns. Called a Retained Life Estate, this plan will let you give your home to The Arc right now, and continue to retain your residence there as long as you live. This plan will allow a charitable tax deduction for a portion of the property’s value, avoid some capital gains taxes and remove the property from the donor’s taxable estate,

For donors of advancing age, the Retained Life Estate clearly defines the disposition of one’s home. This type of gift is easy to make and can be done at no cost. Your financial advisor or legal representative will provide guidance and help make this gift simple and significant for the men, women and children with intellectual and developmental disabilities we serve here at The Arc.

For more information about a mutually beneficial gift of your home via a Retained Life Estate, please contact Neal Benson, Director of Development, at (904) 824-7249 ext. 121, or by email nbenson@arcsj.org.

GIFTS OF STOCK AND APPRECIATED ASSETS

GIFTS OF STOCK AND APPRECIATED ASSETS GIFTS FROM YOUR WILL OR TRUST

GIFTS FROM YOUR WILL OR TRUST